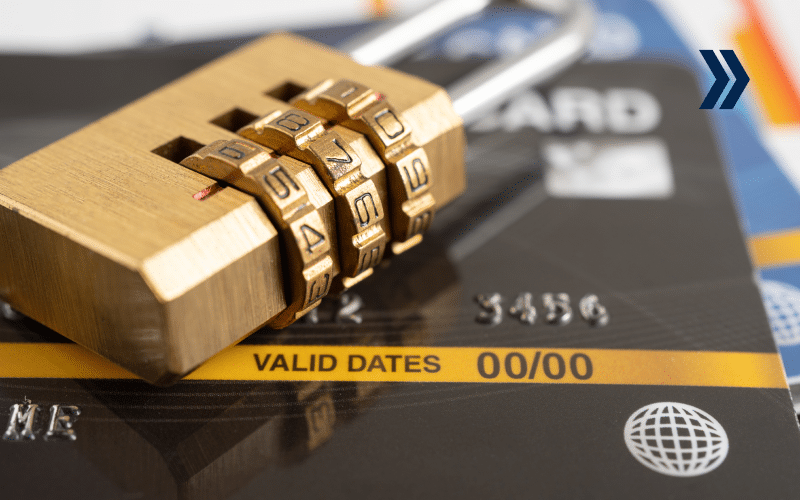

Why PCI DSS Level 1 Payment Processing is Essential for High-Risk Businesses

Discover why PCI DSS Level 1 is critical for high-risk businesses, and how top-tier security supports stable payment processing, bank approvals, and customer trust.

If you’re considered a high-risk business, it’s important to work with payment processors who provide global solutions, APMs, geotargeting & more.

With the right approach, your high-risk business can thrive long-term. Solutions include chargeback management, fraud protection, global payment & more.

Running a high-risk business comes with unique challenges but with the right partner, you can achieve global success. Here’s everything you need to know.

Centrobill MAX Suite features enhanced smart routing, card updating & rebill shifting services. Are you considered a high-risk business? We can help you.

Payment orchestration is like putting all your payment options into one easy-to-use system. It combines different ways to pay

Chargebacks are a bane to business. There are some key advantages to setting up chargeback alerts.

Subscription-based services are a big hit because they provide businesses with steady income and help build customer loyalty

Offering prices in local currencies makes the buying process easier for customers

In this post, we’ll explore exactly why high-risk industries are susceptible to fraud and what we can do to prevent it.

In this post, we’ll explore what you need to know to successfully expand your business into LATAM.

The alternative payment method industry (APM) is expanding to meet the needs of businesses around the world, especially in emerging markets.

This guide will break down the essentials of payment compliance and regulations, to keep your business on the right track.